Austin, Texas Is the Capital of College Athletics

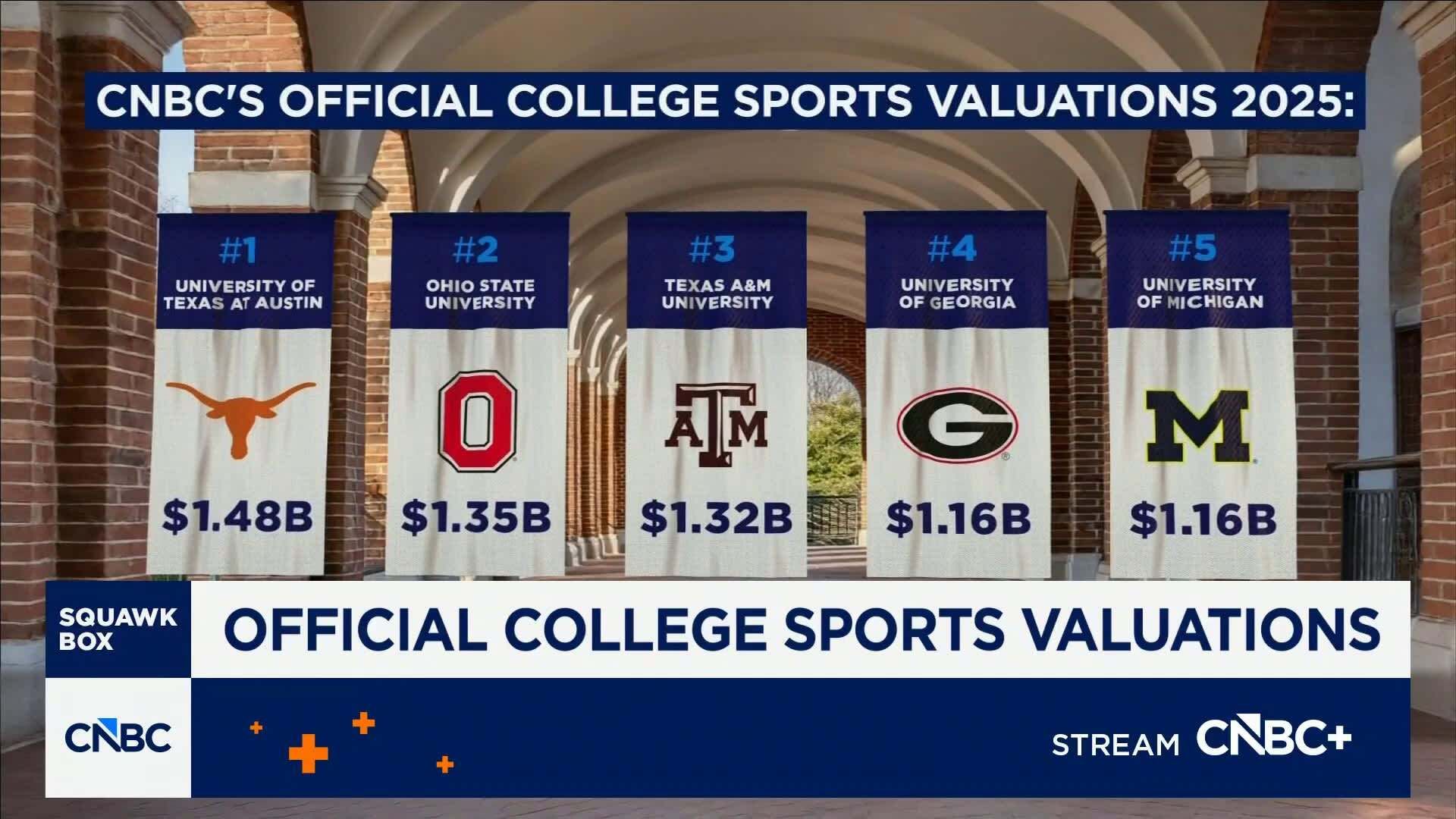

Austin, Texas has officially claimed a new title: home of the most valuable athletic program in college sports. According to a recent valuation by CNBC, the University of Texas at Austin athletic department is now the #1 most valuable program in the nation, surpassing every other school in college athletics.

CNBC valued Texas Athletics at $1.48 billion, marking a 16% increase year over year. That growth was fueled by a staggering $332 million in revenue in 2024, representing a 23% increase from the previous year. With that figure, Texas officially overtook Ohio State University, which ranked second at $1.35 billion.

The valuation underscores what many in college sports have already recognized: Texas is no longer just competing at the top — it is setting the financial benchmark for the entire industry.

How Texas Rose to #1 in College Athletics Valuations

CNBC’s report found that the top 75 athletic programs in the country are now worth a combined $51.22 billion, an increase of 13% from last year. Texas sits at the very top of that list, benefiting from unmatched brand recognition, media exposure, donor backing, conference realignment momentum, and long-term capital investment.

It’s also worth noting that CNBC’s valuation is not the highest estimate on record. Previous analyses by The Athletic and The New York Times placed Texas Athletics at $2.38 billion, further reinforcing the Longhorns’ status as the most valuable brand in college sports, regardless of methodology.

Whether measured conservatively or aggressively, Texas remains the undisputed MVP of college athletics valuations.

CNBC Top 10 Most Valuable College Athletic Programs (2025)

According to CNBC, the ten most valuable athletic programs are:

University of Texas at Austin — $1.48B

Ohio State University — $1.35B

Texas A&M University — $1.32B

University of Georgia — $1.16B

University of Michigan — $1.16B

University of Notre Dame — $1.13B

University of Tennessee — $1.12B

University of Southern California — $1.10B

University of Alabama — $1.09B

University of Nebraska — $1.06B

(A full breakdown of CNBC’s Top 75 rankings and valuation methodology will be included below.)

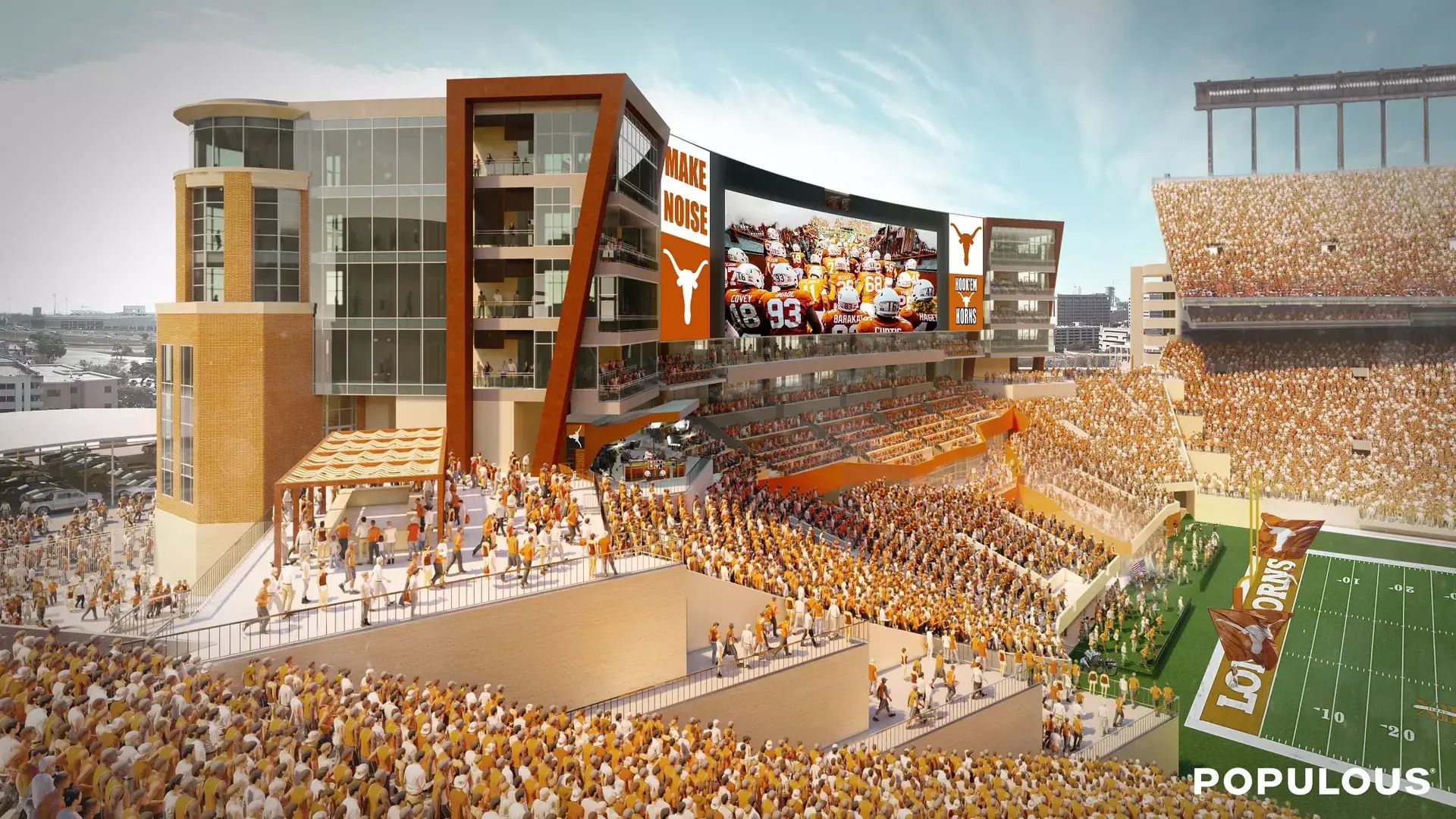

Facilities: Where Texas Is Reinvesting Its Billions

Texas’ rise to the top isn’t just reflected on balance sheets — it’s visible across campus. The university has made hundreds of millions of dollars in facility investments, positioning its athletic programs to compete at a national and professional level for decades to come.

DKR–Texas Memorial Stadium

Texas completed a $175 million South End Zone renovation at DKR–Texas Memorial Stadium in 2024. The project expanded football operations, upgraded player development spaces, enhanced premium seating, and modernized the overall game-day experience, reinforcing DKR as one of the most valuable stadium assets in college football.

Moody Center

Opened in 2022, Moody Center is a $375 million, state-of-the-art arena that serves as the home for Texas Men’s and Women’s Basketball. Beyond athletics, the venue has emerged as a global powerhouse for live entertainment, ranking as the highest-grossing concert venue in the world within its size category, blending college sports with Austin’s music economy at an unprecedented scale.

Texas Football Training Facility

Texas is currently developing a new 70,000-square-foot football training facility, designed to centralize strength training, preparation, and performance development. The project reflects the program’s continued push toward NFL-caliber infrastructure and is expected to open in the near term.

New Volleyball Arena and Student-Athlete Housing

Looking ahead, Texas has announced plans for a new 6,000-seat volleyball arena, targeted to open in 2029. The project will also include student-athlete housing, further integrating competition, training, and living environments while expanding Texas’ commitment to women’s and Olympic sports.

The Bottom Line

At $1.48 billion, Texas Athletics is no longer just the most recognizable brand in college sports — it is the most valuable. Between record-breaking revenue, elite facilities, and long-term investment across multiple sports, the University of Texas at Austin has built an athletic program that operates on a scale rivaling professional franchises.

And with that, Austin, Texas now stands firmly as the capital of college athletics.

Read more about the CNBC valuation breakdown here

Full CNBC Top 75 College Athletics Ranking:

RANK | School | Conference | 2025 valuation | YOY value change % | 2024 revenue | YOY revenue change % | 2024 Rank |

|---|---|---|---|---|---|---|---|

1. | University of Texas at Austin | SEC | $1.48B | 16% | $332M | 23% | 2 |

2. | Ohio State University | Big Ten | $1.35B | 2% | $255M | -9% | 1 |

3. | Texas A&M University | SEC | $1.32B | 5% | $266M | -5% | 3 |

4. | University of Georgia | SEC | $1.16B | 22% | $242M | 15% | 7 |

5. | University of Michigan | Big Ten | $1.16B | 9% | $239M | 4% | 4 |

6. | University of Notre Dame | ACC | $1.13B | 17% | $235M | 5% | 6 |

7. | University of Tennessee | SEC | $1.12B | 19% | $234M | 16% | 9 |

8. | University of Southern California | Big Ten | $1.10B | 19% | $242M | 14% | 12 |

9. | University of Alabama | SEC | $1.09B | 11% | $235M | 18% | 5 |

10. | University of Nebraska | Big Ten | $1.06B | 12% | $221M | 8% | 8 |

11. | Penn State University | Big Ten | $1.06B | 15% | $220M | 9% | 11 |

12. | Louisiana State University | SEC | $1.05B | 15% | $220M | 10% | 13 |

13. | University of Oklahoma | SEC | $1.01B | 9% | $209M | 5% | 10 |

14. | University of Florida | SEC | $975M | 13% | $200M | 6% | 14 |

15. | University of Kentucky | SEC | $910M | 17% | $202M | 16% | 19 |

16. | University of Oregon | Big Ten | $880M | 13% | $169M | 12% | 17 |

17. | University of Wisconsin | Big Ten | $875M | 4% | $191M | -4% | 15 |

18. | Clemson University | ACC | $860M | 8% | $193M | -2% | 16 |

19. | University of Iowa | Big Ten | $835M | 12% | $173M | 4% | 21 |

20. | University of Illinois | Big Ten | $815M | 23% | $174M | 18% | 25 |

21. | University of South Carolina | SEC | $812M | 25% | $183M | 14% | 30 |

22. | Auburn University | SEC | $810M | 5% | $194M | -1% | 20 |

23. | Stanford University | ACC | $805M | 17% | $200M | 11% | 23 |

24. | University of Arkansas | SEC | $800M | 3% | $171M | 2% | 18 |

25. | University of Washington | Big Ten | $795M | 21% | $191M | 26% | 27 |

26. | Michigan State University | Big Ten | $780M | 5% | $164M | -4% | 22 |

27. | Indiana University | Big Ten | $775M | 19% | $174M | 20% | 28 |

28. | Florida State University | ACC | $765M | 14% | $185M | 9% | 24 |

29. | University of Miami | ACC | $760M | 19% | $182M | 14% | 31 |

30. | University of Mississippi | SEC | $755M | 16% | $149M | 5% | 29 |

31. | University of Missouri | SEC | $700M | 19% | $168M | 18% | 35 |

32. | University of Minnesota | Big Ten | $695M | 9% | $151M | 1% | 32 |

33. | Duke University | ACC | $690M | 5% | $167M | 9% | 26 |

34. | Purdue University | Big Ten | $670M | 18% | $135M | 9% | 36 |

35. | Vanderbilt University | SEC | $655M | 19% | $141M | 13% | 38 |

36. | University of North Carolina-Chapel Hill | ACC | $650M | 21% | $164M | 18% | 40 |

37. | University of Louisville | ACC | $645M | 8% | $151M | 6% | 34 |

38. | Mississippi State University | SEC | $625M | 20% | $127M | 9% | 43 |

39. | University of Kansas | Big 12 | $620M | 12% | $135M | 5% | 37 |

40. | University of Virginia | ACC | $610M | 20% | $154M | 9% | 45 |

41. | Oklahoma State University | Big 12 | $600M | 20% | $135M | 11% | 46 |

42. | Baylor University | Big 12 | $585M | 14% | $148M | 8% | 44 |

43. | North Carolina State University | ACC | $584M | 21% | $133M | 10% | 51 |

44. | Northwestern University | Big Ten | $580M | 19% | $124M | 5% | 50 |

45. | Georgia Institute of Technology | ACC | $577M | 16% | $142M | 6% | 47 |

46. | Iowa State University | Big 12 | $575M | 17% | $122M | 5% | 48 |

47. | University of Colorado | Big 12 | $574M | 22% | $147M | 16% | 55 |

48. | University of Pittsburgh | ACC | $572M | 9% | $139M | 1% | 42 |

49. | Texas Tech University | Big 12 | $570M | -8% | $127M | -14% | 33 |

50. | Texas Christian University | Big 12 | $568M | 5% | $142M | -5% | 39 |

51. | Virginia Tech | ACC | $564M | 19% | $139M | 7% | 53 |

52. | University of California, Los Angeles | Big Ten | $539M | 14% | $119M | 13% | 54 |

53. | University of Maryland | Big Ten | $534M | 12% | $128M | 6% | 52 |

54. | Boston College | ACC | $530M | 20% | $137M | 16% | 58 |

55. | University of Arizona | Big 12 | $529M | -1% | $134M | -6% | 41 |

56. | Rutgers University | Big Ten | $506M | 21% | $137M | 10% | 59 |

57. | Brigham Young University | Big 12 | $500M | 40% | $130M | 23% | 64 |

58. | West Virginia University | Big 12 | $481M | 19% | $108M | 2% | 60 |

59. | Syracuse University | ACC | $452M | -7% | $112M | -2% | 49 |

60. | University of Utah | Big 12 | $451M | -4% | $110M | -13% | 56 |

61. | Oregon State University | Pac-12 | $440M | 35% | $120M | 30% | 66 |

62. | Kansas State University | Big 12 | $435M | -2% | $104M | 2% | 57 |

63. | Arizona State University | Big 12 | $430M | 54% | $144M | 25% | 68 |

64. | Wake Forest University | ACC | $405M | 12% | $103M | 6% | 63 |

65. | Southern Methodist University | ACC | $385M | 18% | $100M | 16% | 65 |

66. | University of California, Berkeley | ACC | $370M | -4% | $117M | -7% | 62 |

67. | Washington State University | Pac-12 | $300M | -23% | $89M | 13% | 61 |

68. | University of Cincinnati | Big 12 | $280M | 30% | $97M | 11% | 69 |

69. | San Diego State University | Mountain West | $270M | -6% | $91M | -13% | 67 |

70. | University of Central Florida | Big 12 | $262M | 45% | $98M | 15% | 70 |

71. | University of Connecticut | Big East | $249M | 40% | $106M | 14% | 71 |

72. | University of South Florida | American | $236M | 57% | $104M | 46% | 74 |

73. | University of Houston | Big 12 | $222M | Not ranked | $88M | 29% | Not ranked |

74. | Boise State University | Mountain West | $221M | 26% | $68M | 11% | 72 |

75. | University of Nevada, Las Vegas | Mountain West | $190M | Not ranked | $61M | 0% | Not ranked |